Can the Baidu Index predict realized volatility in the Chinese stock market? | Financial Innovation | Full Text

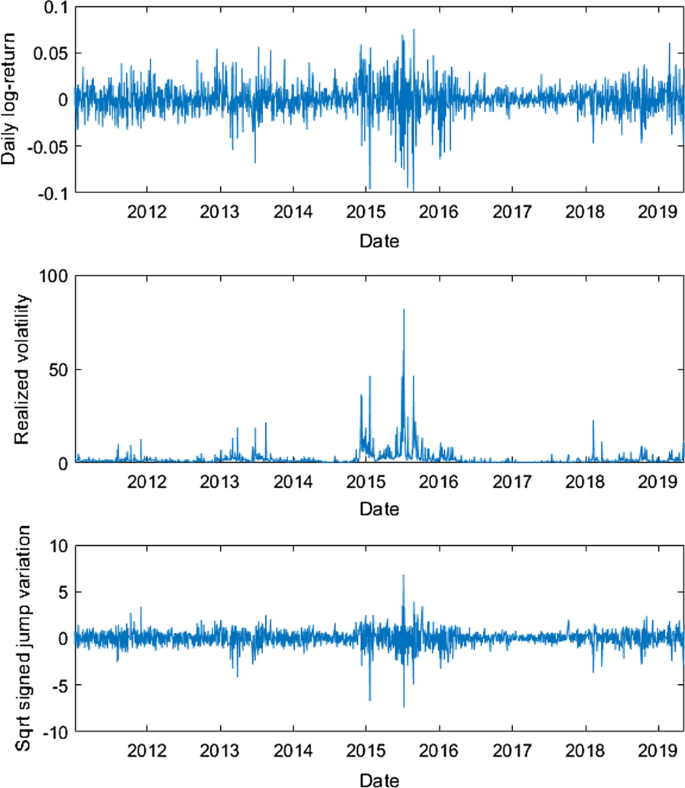

The figure plots the time series of daily log returns, log realized... | Download Scientific Diagram

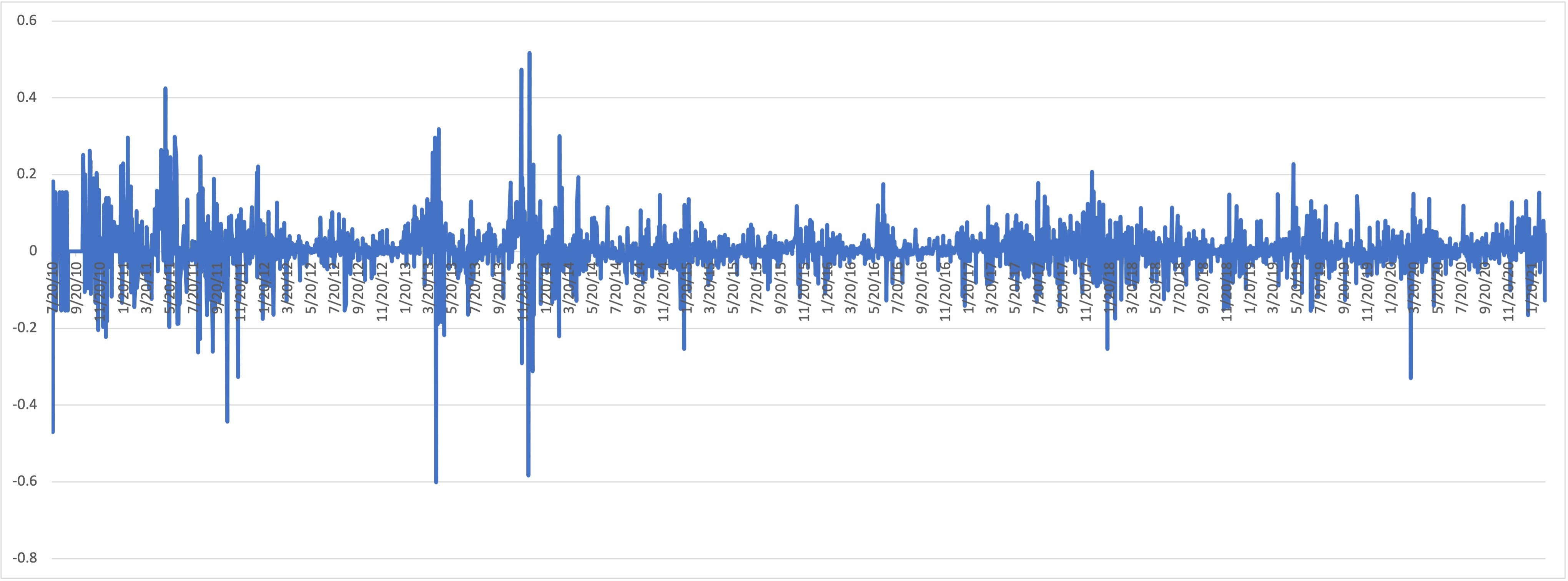

Why the volatility is log-normal and how to apply the log-normal stochastic volatility model in practice | Artur Sepp Blog on Quantitative Investment Strategies

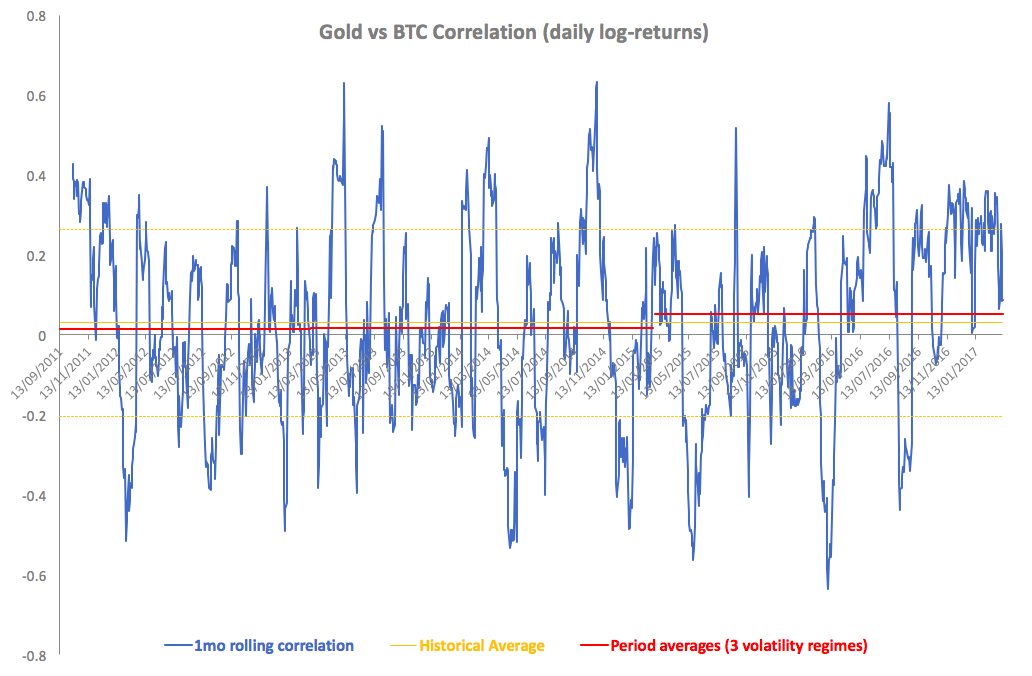

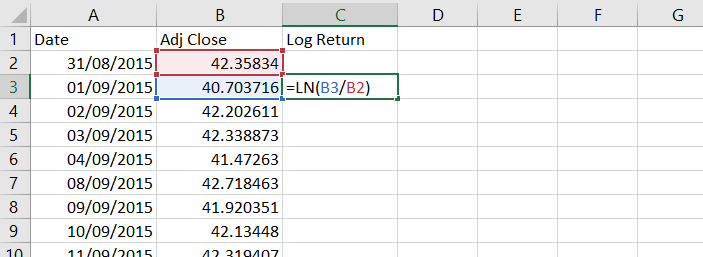

log (ln) returns in volatility calculation and annualization of metrics · Issue #29 · quantopian/zipline · GitHub

:max_bytes(150000):strip_icc()/dotdash_Final_The_Uses_And_Limitt_Of_Volatility_Jan_2020-7be5c97330c64237b3346a05c44013ce.jpg)